3 Steps to pricing your show.

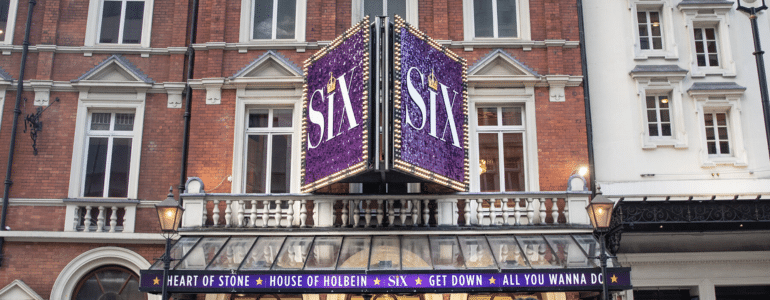

Because this blog is going to be about pricing, let’s just get this out of the way first . . . ready, say it with me, “Broadway tickets are too expensive!”

Ok, we all feel better?

Now, let’s talk about how these (too expensive) prices are derived in the first place.

Marketing 101 tells us that price is one of the fundamentals of the marketing mix. (It’s one of the “4 Ps”, the others being product, promotion and place.) So determining that price is going to be a crucial decision for you as a Producer (or frankly as any kind of business owner) . . . and it’s one of the first decisions you have to make! (How can you market something before knowing how much it’s going to cost?)

So how do you do it? You follow these three easy steps . . .

1. Look at the market.

As one of my first mentors said to me, “Life is an open book test.” One of the first things I’ll do with my ad agency before we even think about what we’re going to charge is look at what everyone else is charging. How much are the big hits that opened years ago charging? How much are the brand new shows charging? Plays versus musicals? Within a few minutes we’ll have a range of what shows like mine are charging and boom, we’ve already narrowed it down to what we think the market will bear. Now the question is, where do we fit on that scale?

2. Look at the budget.

This is one of the reasons that theater tickets are expensive. While we’d all love to just charge a heck of a lot less for tickets, Producers need to make sure that the price of the product is not only equal to the value of the product (live entertainment should be more expensive than recorded entertainment, just like a Mercedes should be more expensive than a Smart Car), but that it also works within the budget of the production. To extend that car metaphor, think of a budget like a giant car engine . . . and the right price is like the right key . . . it starts it up, and gets it running perfectly. Broadway investors, like all investors, look for recoupment rates that are achievable, and provide a chance for significant upside (when you take a risk like investing in a Broadway show, you want to make sure you can make some good money on the other side, if you’re lucky enough to get there). Finding the right price is “key” to making sure your financials are attracting enough to get your show on the road (while using Step #1 to make sure you’re not driving outside the lines).

3. Look at the sales.

Once you get through Steps #1 and #2, you should have an idea of what you want to charge. So what do you do? Set it . . . except do NOT forget it. Set it, and watch it. Closely. Prices can and SHOULD be changed depending on how the audience reacts to them. I’ve changed my full price on some shows countless times . . . especially long runners (do you think Phantom is still charging the same as it did when it opened?). I’ve dropped prices two months after opening. I’ve increased prices by as little as $0.49 a year into a run (that netted me around $50k in just one year). More than ever, the price for your product can be “variable.” Launch, then test, change, shift, go up, go down . . . until you are maximizing your sales.

Setting the price for your show can be very stressful. What if I set it too high and no one buys? What if I set it too low and I can’t make my “nut?” Follow the steps above, and it’ll minimize your stress, and maximize your returns.

But how do you know if you’ve priced it correctly?

I asked another mentor that same question about twenty years ago and he said, “Well what do you think, Ken?”

“If I sell out the house?”

“Nope.”

“Then what?”

“You’ll know you’ve priced it perfectly if you sell every single seat in the house . . . except one.”

(Got a comment? I love ‘em, so comment below! Email Subscribers, click here then scroll down to say what’s on your mind!)

– – – – –

FUN STUFF:

– Win 2 tickets to see The New York Pops Featuring Sutton Foster! Click here.

– 3 days left to apply for the Spring Awakening Associate Producer Scholarship! Click here.

Podcasting

Ken created one of the first Broadway podcasts, recording over 250 episodes over 7 years. It features interviews with A-listers in the theater about how they “made it”, including 2 Pulitzer Prize Winners, 7 Academy Award Winners and 76 Tony Award winners. Notable guests include Pasek & Paul, Kenny Leon, Lynn Ahrens and more.