Do Broadway shows need bigger reserves? Part II

Ok, now we get to the good stuff.

Yesterday, we talked all about the all-important reserve in Broadway Budgets, and how they are used and when they are used (and how we all dream of doing shows that never have to tap into them – because then you can just distribute them back to the investors right away!).

But the question that got us started on this topic was . . . how big are they, and in 2015, should they be bigger?

Here’s why it’s an issue:

A fairly traditional rule of thumb has been that your reserve should be 10% of your production budget. So a $10mm show should have $1mm in reserve (remember a reserve will be used for budgetary overruns, preview losses, and anything else you don’t want to happen!).

I always like to make my reserves a bit bigger, to have a little extra cushion or some “mad money” if a wonderful opportunity comes up that you haven’t planned for (a star wants to do your show at the last second, or an incredible billboard becomes available).

And lately, I’ve started to wonder if that rule of thumb is a little low.

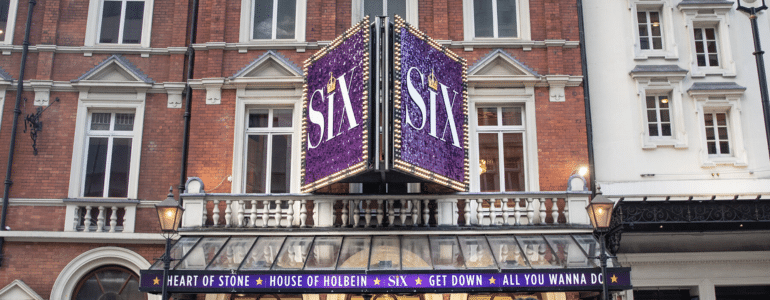

Here’s why . . . the competitive landscape is now busier than ever. With more shows on the boards, it now takes shows longer to get out of the gate, and get the attention of theatergoers. There are more ads for them to sort through, more recommendations from friends, etc.

So I’m seeing a trend of shows running out of reserve money a little bit quicker than they used to.

And that means shows that aren’t ready to give up the ghost and close have to raise more money.

Here’s where it gets tricky . . .

When Producers raise more money after the original offering has closed (usually tied to the opening of the show), that money is traditionally taken in the form of a priority loan. And a priority loan is exactly that . . . it’s a loan, that is put in 1st position (priority) over all the other payback to investors.

So, in other words, if a show makes money after getting a priority loan, that loan has to be paid back before investors receive any funds. If the loan works, and the show turns around and pays back its loan, then and only then do investors start to get monies returned to them.

What happens if the show doesn’t turn around? Well, the loan is lost, or stays in first position in case anything else happens with the show (licensing money, film, etc.) . . . and the investors stay in second position, most likely never to receive a dime.

Sad times for them.

And that’s why I wonder if reserves should be bigger. With a bigger reserve, the first investors don’t get put in second position if the show is in trouble. So if the show doesn’t work on Broadway, but is a hit in the summer stock and amateur world, they will start to recoup their losses. When there is a loan in front of them, they never get anything (and licensing is sometimes a reason why people invest).

Of course, a bigger reserve means more money to be raised up front. And some Producers would rather keep their initial budgets lower, and then just go out and raise more later.

But I’m starting to wonder . . .

What would you rather do? Raise more up front? Invest more up front? Do you think reserves should increase?

I’m staring at a Broadway budget right this very second, and I’m still figuring it out for myself . . .

(Got a comment? I love ‘em, so comment below! Email Subscribers, click here then scroll down to say what’s on your mind!)

– – – – –

FUN STUFF:

– Listen to Podcast Episode #28 with Victoria Bailey, the Executive Director of TDF! Click here.

– Win 2 tickets to Spamalot at the Hollywood Bowl! Click here.

Podcasting

Ken created one of the first Broadway podcasts, recording over 250 episodes over 7 years. It features interviews with A-listers in the theater about how they “made it”, including 2 Pulitzer Prize Winners, 7 Academy Award Winners and 76 Tony Award winners. Notable guests include Pasek & Paul, Kenny Leon, Lynn Ahrens and more.